One of the challenges businesses face when doing business in Africa is the stability and availability of forex. Local companies need to manage their treasury effectively to minimize forex losses and have enough forex to import essential products and services. Forex availability in Africa is influenced by various factors, including central bank USD reserves and trade balances.

When conducting multi-country analyses for our clients, we often assess the availability of foreign exchange and currency stability, among other indicators. In a recent project, our analysts highlighted the situation across specific African nations.

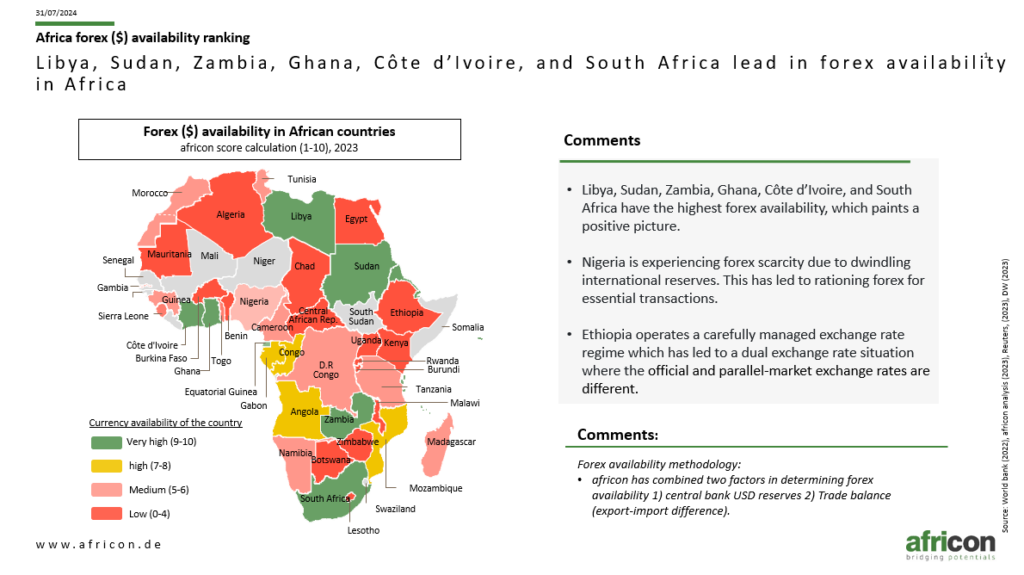

We employed a methodology that combined two critical factors: Central Bank USD reserves and the trade balance (export-import difference). These factors are strong indicators of the likelihood for local operators to experience ease or hardship in obtaining necessary forex.

Some insights;

- Libya, Sudan, Zambia, Ghana, Côte d’Ivoire, and South Africa have a high availability of forex, painting a positive picture.

- Conversely, Nigeria is experiencing a forex scarcity due to dwindling international reserves, leading to the rationing of forex for essential transactions.

- A carefully managed exchange rate regime in Ethiopia has resulted in a dual exchange rate situation where the official and parallel-market exchange rates differ.

At africon, we provide country-specific information to our clients as part of their Africa strategy development. As you chart your company’s strategy for the rest of the year, rest assured that africon is by your side, ready to provide clarity, expert guidance and tailored solutions. Our comprehensive insights and strategic recommendations are designed to help you create and refine your Africa strategy.