How many bottles of edible oils does Kenya produce annually? This is one of the key questions raised by our client in the FMCG sector. They were interested in learning about the edible oil industry in Kenya.

Our findings revealed that Kenya produces a variety of edible oils for domestic consumption and export. Kenya’s most consumed ones include vegetable, palm, and coconut oil. Others include olive, avocado, and sesame oils, often imported and more expensive than locally produced oils.

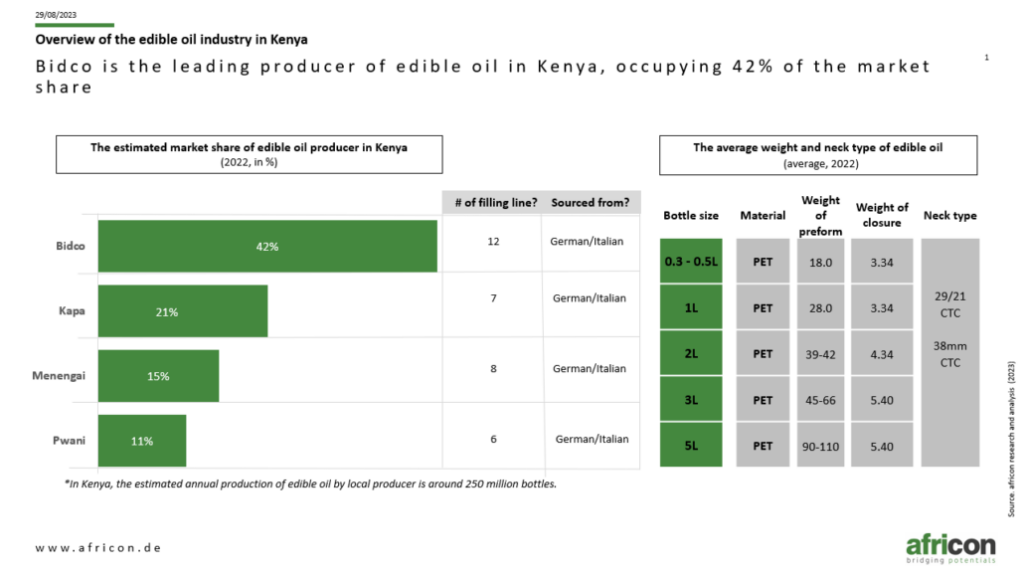

Regarding production, some of the major players in the Kenyan edible oil industry include Bidco Africa, the largest manufacturer in the country, with a market share of 42%. The company produces a wide range of cooking oils under the brands Elianto, Kimbo and Golden Fry. Kapa Oils is the second-largest manufacturer of edible oils in Kenya, with a market share of 21%, producing cooking oil under the KAPA brand. Third is Menengai Oil Refineries, with a market share of 15%. The company produces a range of cooking oils, including vegetable oils, sunflower oil and palm oils under the Sunpure and Zesta brands. Pwani Oils is a smaller player in the Kenyan edible oils industry, with a market share of 11%. The company is famous for brands such as Sawa and Fresh Fry.

Other smaller Kenyan edible oil industry players include United Millers Limited, Mount Meru Group, and African Industries Group. They constitute the remaining market share.

Generally, the consumption of edible oils in Kenya is on the rise due to increased population, urbanization, and changing dietary habits. The demand for healthier oils, such as olive and avocado, is also increasing as people become more health conscious.

We consolidated all these findings into a comprehensive report and offered tactical recommendations to the client.

Read previous SOTMs (Slides of the month) here

Slide of the month (SOTM) May. The size of Africa’s travel retail market

Slide of the month (SOTM) March. 77% of German chemical companies see a big potential in Africa.

Slide of the month (SOTM) February. Green Hydrogen Opportunity in Africa